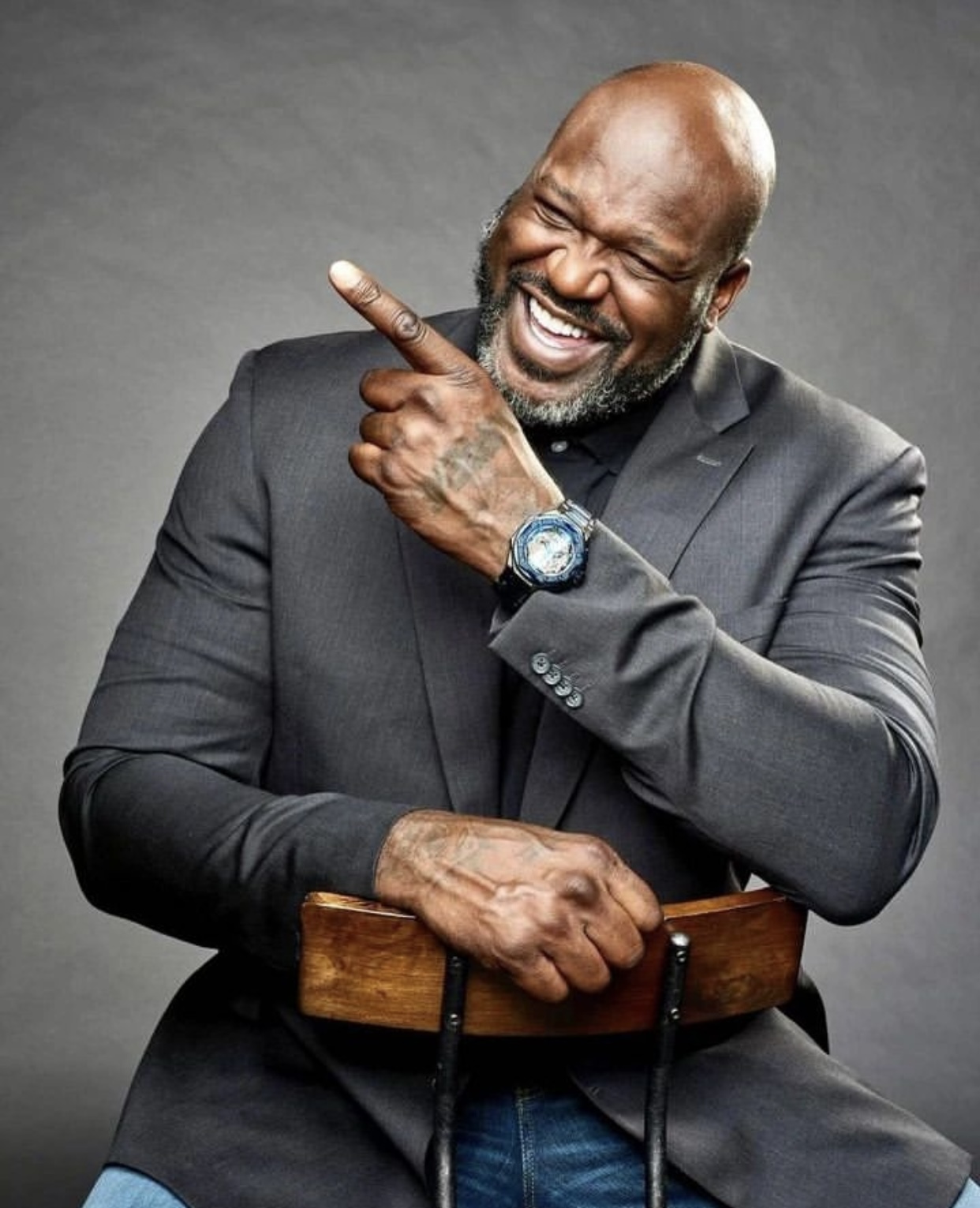

The Masterstroke of a Titan: Shaq O’Neal’s Robust Tax Strategy

From the days of slam dunking in the NBA, Shaquille O’Neal has evolved into a thriving entrepreneur and business magnate whose tax strategies can be as deft and precise as his legendary free-throw. While he made his name on the court, his techniques for financial engineering and taxation trot upon an entirely different arena; one that’s as demanding and rigorous.

Self-proclaimed ‘Superman’, Shaq has brilliantly incorporated his name into a brand, leveraging his image and popularity to create a broad spectrum of income avenues from endorsements, investments, and various ventures. This business superstructure, cleverly constructed around Shaq’s stardom, is a fantastic example of how top athletes and personalities smartly circumnavigate the choppy seas of taxation.

Understand this. Shaq isn’t merely a retired basketball player. He’s the CEO of Shaq Inc., an entity that profits from the ‘Shaq’ brand. By incorporating his personal brand, he is converting personal income into business income. The earnings, therefore, instead of being taxable as individual income at higher rates, become corporate earnings, taxable at a lower rate. But, this not just about tax rates, it’s about brilliant financial maneuvering.

Employing his parents by putting them on the company’s payroll, Shaq simultaneously achieves two significant benefits. Financially, it converts natural familial expenditures into legitimate, tax-deductible, business expenses. Emotionally, it provides his parents with a recognized role within his empire and fosters familial harmony.

Moreover, operating under the corporation allows Shaq to claim deductions for valid business expenses – everything from travel to entertainment attributed to maintaining and promoting the ‘Shaq’ brand. These deductions further reduce the taxable income and, by extension, the tax liability. This approach also shields him from liability, as all legal actions are against the corporation and not him personally.

Here’s the kicker. Investments. Shaq is no newbie when it comes to diversifying his wealth. His stakes in companies like Google, Apple, and even nightclubs are smart ways of growing his fortune. Capital gains from these investments carry favorable tax rates compared to ordinary income.

Finally, don’t forget about philanthropy. Philanthropy achieves two critical purposes: tax deductions and public goodwill. From the ‘Shaq’ brand standpoint, more favorability corresponds to more future earnings. We should never underestimate the power of a good public image.

So, here lies Shaq’s secret to winning at the taxation game: Instead of playing a defensive game, a well-strategically built offense can ensure victory. His approach encapsulates this strategy. As he sinks three-pointers in the tax game, he secures further wealth while also contributing back to society by creating jobs and supporting worthy causes.

However, remember folks, we are talking about Shaq O’Neal, and his financial might may not be something that can be achieved by everyone. But there are undoubtedly lessons to be learned here for everyone looking to optimize their tax strategy.

Shaq’s tax strategy is no different from his basketball game – strategic, tactical, and always full steam ahead.

Slaylebrity Net Worth

Social fans: 32 million +

EST Net Worth : $400 million