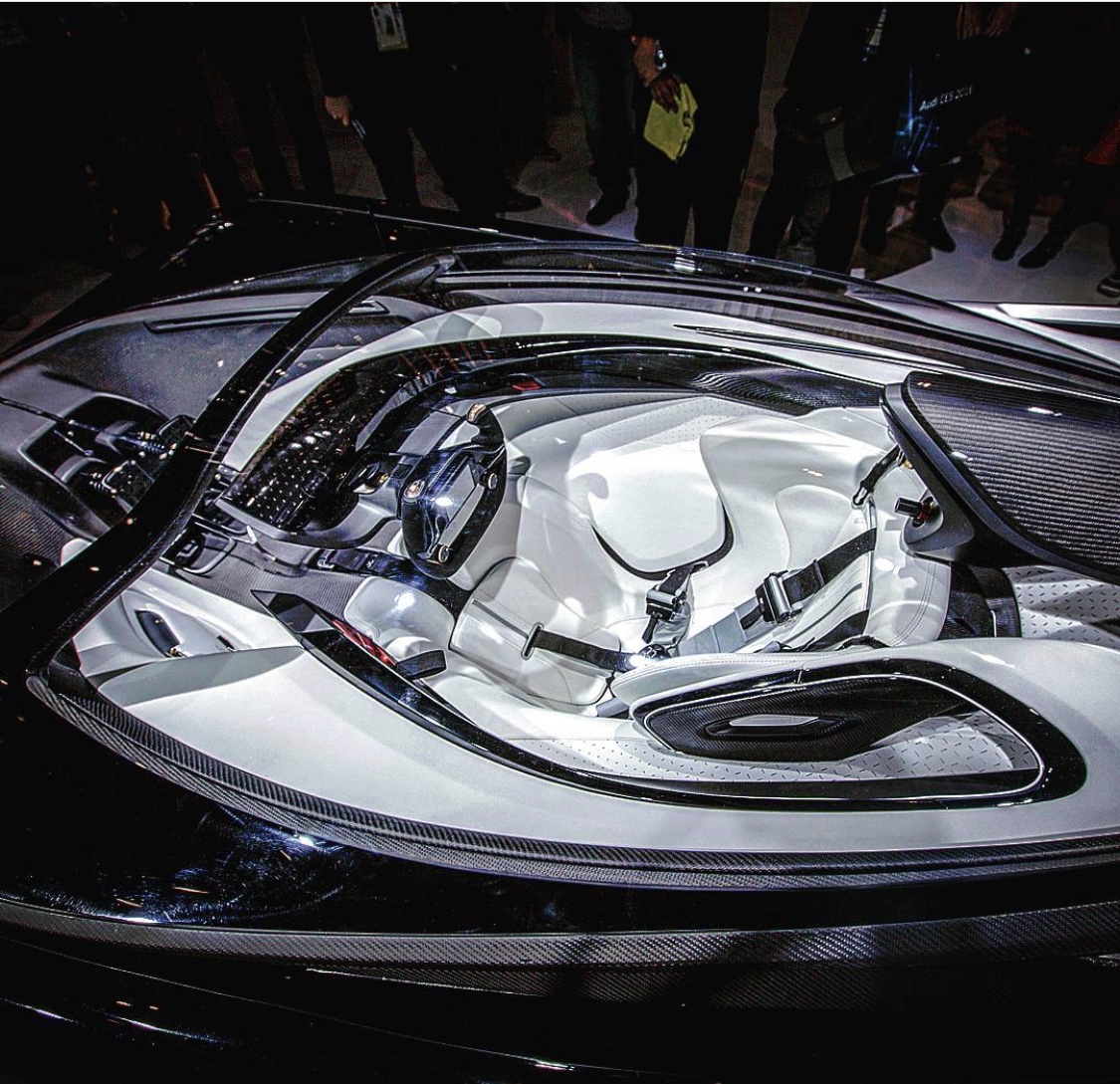

Unveiled at the 2016 Consumer Electronics Show in Las Vegas, the Faraday Future FFZERO1 Concept is an amplified exhibition of the same design elements developed in Faraday’s production vehicles, intensified to match FFZERO1’s high-performance engineering. It is more than a concept car—it is a car of concepts!

Smartphone Connectivity

The driver’s smartphone can be connected directly into the car, allowing for real-time data visualization and interaction. Used separately, the smartphone app enables remote setup, customized vehicle configurations, and adjustable power outputs

Sculpted Around You

The goal was to build a car with a sixth sense for its driver’s needs—an advanced vehicle that offers thorough personalization, seamless implementation of vehicle configurations, and effortless access to real-time data.

The story of the Man behind the Faraday Brand

Faraday Future, once the most hyped electric vehicle startup following in Tesla’s wake, is now known for its money troubles, if it is known at all. Flashy hires — from SpaceX, Tesla, Apple, and Ford — have mostly moved on. The $2 billion it has spent to develop a luxury SUV hasn’t paid off; the vehicle is still not in production. This is all thanks to the company’s founder, a man who ran from China in 2017 to escape billions of dollars of debt, only to declare bankruptcy in the US this month: former Faraday Future CEO Jia Yueting.

Smart money has the company on death watch. But Faraday Future is still alive, and its new CEO would like to explain why.

During a “media day” held last year at Faraday Future’s headquarters, which is across the street from the Pet Haven Cemetery and Crematory in Gardena, California, newly appointed CEO Carsten Breitfeld told a dozen reporters and bloggers that he joined the struggling EV startup because he believes it can become “the number one company in future mobility.”

Wearing black loafers, black socks, dark jeans, and a shiny black Faraday Future polo, Breitfeld flipped through slides on an enormous video wall behind him and explained in a thick German accent that the transportation industry is due for another revolution. While Faraday Future has relatively little money in the bank, owes more than a $100 million to suppliers, and has a reputation that’s tarnished by Jia’s financial and managerial shenanigans (which The Verge has documented over the last two years), Breitfeld claimed Faraday Future is uniquely equipped to transform transportation as we know it.

It’s a bold vision Breitfeld now has to sell to investors, potential new hires, and the company’s own creditors. If he succeeds, Breitfeld said the startup will return to the Consumer Electronics Show in 2021 where it will debut a new vehicle and platform that Faraday Future plans to use to disrupt the mobility industry.

Surviving until then would be a feat unto itself. But in order to even try, Breitfeld must reanimate Faraday Future while keeping Jia in check. Despite the fact that Jia stepped down as CEO and filed for bankruptcy, the man at the center of the startup’s greatest struggles is not going anywhere anytime soon.

Storm clouds roll in, set to a sad string arrangement, before the music video cuts to footage of smog-choked China where cars appear to be backed up for miles. Then, above the strings emerges the voice of billionaire Jia Yueting, the founder of Chinese tech conglomerate LeEco and EV startup Faraday Future.

“We firmly believe that the 1 percenters can make history,” he says in Chinese, according to a translation of the lyrics.

Then, the music video, which was distributed internally at LeEco amid the company’s collapse in 2017, cuts to footage of Jia wearing black over-the-ear headphones. Standing in a recording studio, the billionaire tries to croon his thanks to “all the cold, indifferent people” for “looking at him dismissively.” Their criticisms have roused him to life, he wails.

Later, Jia turns directly to the camera and says he’d “like to share this song to encourage all the entrepreneurs.”

“No matter how crazy the thunderstorm is, as long as you are persistent and never look back, you will surely meet the vast world, or even harvest in the desert,” he says.

Jia’s brash personality, on full display in the video, is one of the reasons he made a name for himself in China. (He once compared Apple to Hitler during LeEco’s rise, for example.) Jia was similarly bold in the way he built up his business, taking on billions of dollars in debt to fuel LeEco’s transition from the “Netflix of China” to a conglomerate that made phones, televisions, and even attempted electric cars.

But Jia’s ambition caught up to him in late 2016 when he unsuccessfully tried to introduce LeEco to the US. Just weeks after a blustery product launch in October, he announced layoffs and claimed LeEco was suffering from “big company disease.” Six months later, after the music video was sent around inside LeEco, the Shanghai High People’s Court froze $182 million of his assets. He was eventually named to an official debtor blacklist in China, and when the government ordered him to return to face his creditors, he had his wife and brother answer the call instead.

With creditors literally camping out in LeEco’s offices in hopes of being repaid and the government breathing down his neck, Jia moved to California in July 2017 where he had founded a new company three years earlier: Faraday Future. He settled into a mansion on the coast, one of a handful of multimillion-dollar homes he had purchased with a shell company in 2014 and 2015.

Moving halfway around the world wasn’t enough to escape the “crazy thunderstorm” from his music video, though, because Jia had created another crisis at Faraday Future.

After Jia founded Faraday Future in 2014, the startup hoovered up talent from the biggest companies in Silicon Valley and Detroit in an effort to build a luxury, ultra-connected electric SUV called the FF91. The hiring spree mixed with the startup’s overwhelming secrecy to create such potent hype that, at one point, it was rumored that Faraday Future was a front for Apple’s self-driving car project.

But Jia — who quietly ran the company from the beginning — spurned the advice of the automotive executives he hired and set overly ambitious goals for Faraday Future, The Verge learned in 2017.

Jia quickly burned through most of the $900 million he pumped into the company. By the time Faraday Future unveiled the FF91 at the 2017 Consumer Electronics Show, the startup was already behind on bills, had lost some key staff, and delayed construction on a $1 billion factory in the Nevada desert.

A few months later, the startup hired former BMW and Deutsche Bank chief financial officer Stefan Krause to fix its finances. He eventually decided bankruptcy was the solution. Seeing this as a challenge to his controlling stake in the company, Jia fought Krause’s effort behind the scenes. Krause ultimately resigned in October 2017, and Jia named himself the first public CEO of Faraday Future, cementing what many employees already knew: he was running the show.

By late December, Faraday Future was weeks away from not having enough money to cover payroll, so Jia traded 45 percent of Faraday Future’s shares in exchange for a $2 billion investment from Chinese real estate conglomerate Evergrande. But Jia still owned a third of a class of shares with more voting rights. So even though Evergrande owned a significant chunk of the company, Jia was still in charge. (Jia did not respond to an emailed request for comment.)

In 2018, Faraday Future spent the first $800 million of Evergrande’s investment in just six months. Then Jia asked for an advance on the rest of the money. Evergrande tried to use this opportunity to marginalize the founder and asked him to transfer his controlling shares in the company to an independent third party in exchange for the money. Jia agreed but transferred the shares to his vice president’s daughter. In response, Evergrande refused to make further payments.

This left Faraday Future in the lurch. Only Jia’s inner circle knew about the battle with Evergrande, according to two former high-level employees who were granted anonymity due to nondisclosure agreements they signed with the company. Faraday Future’s Western executives — the ones with the automotive industry experience — were left in the dark. In fact, they found out the truth just days before the company’s “futurist day” event on September 19th, 2018. (Faraday Future spokesperson John Schilling denies this, saying, “We were transparent with management on these types of matters in a timely manner.”) At the event, executives told employees and their families that Faraday Future was still on track to start production by the end of the year.

As a result of the fight with Evergrande, Faraday Future had just $18 million in the bank at the start of September 2018, according to information shared in court in November 2018 by Faraday Future’s own finance vice president. That was just $2 million more than the monthly cost of its payroll; suppliers, meanwhile, were owed at least $59 million. So in October 2018, Faraday Future began a series of rolling layoffs, furloughs, and salary reductions. Many of the top Western executives quit, including co-founder and former Tesla and Lotus engineer Nick Sampson.

Faraday Future and Evergrande ultimately renegotiated their deal on the last day of 2018: Evergrande reduced its stake to 32 percent, was released from any further financial obligations, and allowed Faraday Future to seek new investors. Faraday Future finished 2018 with just $7.4 million in the bank, though it was given one final $10 million loan from Evergrande. According to Jia’s recent bankruptcy filing, this loan is still outstanding. (Schilling says the startup was “not able to secure the funding we originally thought we would have by [the due date] to pay this back so we pushed it back.”)

New investors weren’t interested in Jia and thus weren’t interested in Faraday Future as long as he stayed in charge, according to a former employee close to the investment discussions who was granted anonymity due to the nondisclosure agreements Faraday Future requires. They had good reason to be wary, this person said, as Jia once used LeEco to buy a large stake in rival EV startup Lucid Motors. This was an obvious conflict of interest and, perhaps predictably, Jia used his position at Lucid to block potential investments in that company.

“Investors’ primary request is, ‘Will you just move aside and be the face, and let us run the thing?’” the person close to the discussions said. “And his answer is always ‘No’ or ‘You can get a new CEO, but they’ll still report to me.’”

Breitfeld, the new CEO, spent much of the media day acknowledging the drain that spending two-plus years in near-constant financial crisis has had on the company, while performing “yes, but” pivots:

Yes, the FF91 is still months away from production, he said, but it will outperform and out-luxe almost every other EV on the market when it hits the road. Yes, Faraday Future still needs another $850 million to make that happen, but there is value in the company’s in-house technology, intellectual property, and other assets.

Yes, Faraday Future laid off hundreds of workers and lost key executives, and yes, many suppliers are still owed lots of money. But the restructuring firm has set up a trust for the suppliers, and the $1.7 billion the company has spent so far did not simply vanish. Much of that capital went to developing an SUV that’s overflowing with the kind of technology Breitfeld thinks will help disrupt the transportation industry.

In that vein, Breitfeld said he wants Faraday Future to be more open, both about what it has and hasn’t accomplished to this point as well as what he plans to do if he can successfully solicit new investors.

“There was a strange attitude here, where people would say, ‘Hey, we cannot show anything to the outside world,’” Breitfeld told The Verge about the way Jia ran things. “This is completely wrong, because only negative news has been out about this company, and nothing about the substance. All the other startups are talking about the things they don’t have right now, and we are not talking about the things we have. How crazy is this?”

What substance? For starters, the FF91’s battery pack, electric motors, and inverter have been designed and are packaged in such a way that they can be easily adapted to cars of different sizes and price points.

Faraday Future developed these components of its electric drivetrain in house, too, making it something of its own supplier. This gives the company more control over the way these parts all work together, echoing how major corporations like Apple tend to design their products. That helped Faraday Future design more powerful motors that don’t easily overheat, making it possible to zip from 0 to 60 over and over again. Faraday Future also claims to have developed one of the only cars with a battery pack that can match Tesla’s industry-leading range figures.

The motors and inverter are the work of the team that developed the EV1 for General Motors, which is regarded as the first mass-produced electric car of the modern era. While almost all of that team has since left Faraday Future for rival startup Rivian, their work didn’t leave with them, and it remains a source of pride for the employees who’ve stuck with the startup as well as a possible point of interest for potential investors.

In keeping with Breitfeld’s promise of showing more work, the startup unveiled the FF91’s interior for the first time. The SUV of the future is crammed full of screens: 11 total, with more than 100 combined inches of screen real estate. The centerpiece is a 27-inch display that folds down from the ceiling, offering rear-seat passengers a theater-like experience enhanced by cooling and heating systems as well as massage motors. The seats also tilt back to a 60-degree angle.

There’s another large entertainment screen in the dashboard ahead of the front passenger seat, which is recessed so the driver cannot see it, the company explained. A massive vertical touchscreen protrudes from the center of the dashboard, and there are even touchscreens on the inside of each door to give each passenger quick access to their own climate and seat adjustments. Apparently, the “future” in Faraday Future means putting as many screens as possible in a car.

Drivers and passengers can also interact with the car’s software using voice controls, which the company says will be able to handle compound queries, such as “find a restaurant with an open patio within five miles.” The car is also outfitted with a number of cameras on the inside that can recognize drivers and passengers and quickly dial in their favorite personal settings.

One problem with such a tech-dense approach is the car was supposed to be in production by now, which means some of the tech is slipping out of date. For this, Faraday Future executives offered one more “yes, but”: yes, that wasn’t the plan, but the delay has given the remaining team time to try to work new processors and cameras into the car’s design ahead of the targeted production date of 2020.

The cost, of course, is stupendous: the FF91 will be priced somewhere between $150,000 and $200,000, should it ever go on sale. But Breitfeld believes it will be an attractive car for the well-to-do in China, which he expects to be the primary market. And if things go well, which is a big if, the FF91 will just be the beginning of a comeback story that will see the startup become more than just an automaker, Breitfeld says.

Following the FF91, Breitfeld wants to use Faraday Future’s electric platform to power smaller, more affordable cars. This second-generation version of the platform, which he said will be revealed at CES 2021, is the focus of what he believes the real business opportunity is for Faraday Future: remaking ride-hailing and car-sharing with high-tech vehicles that serve as a platform for revenue-generating software services.

While services like Uber get you where you’re going neatly and safely, Breitfeld believes “the experience is quite poor” during the ride. “We don’t have the right product for it,” Breitfeld said confidently. “Your phones are not connected. You don’t have access to your music, nothing. It’s just sitting in and going from A to B.”

Breitfeld wants to solve this imagined problem by transferring the tech Faraday Future created for the FF91 to something more appropriate for these shared mobility settings. He wants a car that could recognize a user “through facial recognition or whatever you want,” and then download their “digital ecosystem into the car” over 5G. This way, Breitfeld said, the car “will feel like yours within seconds.”

Breitfeld didn’t explain why tech like facial recognition is a better solution than what’s already available, though. For what it’s worth, Uber has a deal with Pandora and Spotify, and ride-hailing apps already know who you are when you book a car.

The screens are where Breitfeld sees the biggest dollar signs: selling services to the captive audience in Faraday Future’s cars.

To hammer home this point, Breitfeld presented a slide that featured an outline of the FF91. Above the vehicle were four logos: Tesla, Google, Apple, and Uber. A fifth logo was positioned above everything else: Faraday Future’s “FF” iconography.

“You might smile or laugh a bit. But the target of Faraday Future is to bring those business models and competences together in one company, and create it and put it into one digital eco shared mobility system,” Breitfeld said. “Tesla is building electric cars, and was the first company who really created a strong premium brand for electric cars. Google may be the best company at managing data, and making something out of data. Apple is most likely the best company when it comes to user experience. And Uber — and you could mention others like Didi and Lyft as well — making shared mobility business models work.

“But what you really need to become a disruptor, and to be the next company dominating shared mobility systems in the future, is you will have to combine all of these,” Breitfeld added.

By 2030, Breitfeld claimed this super-company version of Faraday Future will generate nearly half of its revenue from vehicle sales and the rest from a combination of car-sharing, in-car services, as well as sales or licensing of the company’s technology. But nearly 70 percent of the profit would come from those more service-y parts of the business.

“I think this can happen,” he said. “There’s still a long way to go. There’s no doubt about it. But this can happen. And this will put us in a position that we can become definitely the number one company in future mobility.”

Can Faraday Future accomplish any of this with Jia still around? At the media day, Breitfeld claimed the founder won’t be an issue because Jia put his controlling shares in the hands of a new committee made up of company lawyers and executives. Breitfeld also said Jia stepped down from the CEO role at his request (“I told him there’s only one position I’d consider to come on board here,” he told The Verge) and now, allegedly, has less control over the company’s operations. On October 14th, Jia personally filed for Chapter 11 bankruptcy in an effort to settle the $3.6 billion in debt he’s still on the hook for in China.

But Jia still holds veto power over certain decisions, and he will continue to shape the technology in Faraday Future’s vehicles as its “chief product and user officer.” Jia’s also still drawing a significant salary from Faraday Future, according to his bankruptcy filing. Even though he pledged to take only $1 as a salary during last year’s layoffs, Jia currently makes $50,000 each month at the startup. (Schilling says he “cannot comment on current compensation levels” for executives.)

Breitfeld says Jia told him (with a kind of humility the founder isn’t known for): “‘If you come here, I’ll let you run the company, because I know what I can do and what I’m good at, and I know what I’m not so good at.’ Again, his words. And it’s really a great decision, I would say.” Breitfeld cites the founder’s “leadership” and “know-how of all the digital technology” as being crucial to the company’s future.

But even if Jia has relinquished some control, potential investors will likely have to deal with him retaining a presence at Faraday Future for one particular reason: his immigration status.

Jia remained in the US on an L-1 visa, according to a person with direct knowledge of his immigration status who was not authorized to share the information. L-1 visas allow companies to either transfer executives and managers to existing affiliates in the US or let those executives and managers enter the country with the purpose of establishing an affiliate. Crucially, the business “must be viable.” That means without Faraday Future or his role there, Jia may be forced to return to China, where he has to face his creditors and the government.

Being in the US on this particular visa helps explain why Jia has so ferociously fought efforts to diminish his role with (or outright dissolve) Faraday Future, especially after LeEco’s US operations shuttered in 2017. It’s not clear whether Jia has sought a more permanent stay; a Chinese blogger in Seattle claimed Jia was applying for a green card in 2017, but LeEco executives called the information “fake news,” and Jia sued the man for defamation. The case was ultimately settled. (Schilling declined to confirm Jia’s specific immigration status, saying only he has “status to stay and work in the US legally.”)

Breitfeld’s take on the role Jia now has in the company is rosy. But Jia’s promises — like a $1 salary that turned back into $50,000 a month — suggest Breitfeld may have more to worry about, as no one has successfully clawed power away from Jia at Faraday Future yet.

IN many ways, Breitfeld is the CEO Faraday Future always lacked. The startup spent its first three years without a publicly designated CEO (though several names rotated through the role on official paperwork, as The Verge previously reported). Even when Jia stepped in, he had no real automotive experience to speak of. Breitfeld not only has a deep well of experience from his time at BMW, but he also presumably has a sizable Rolodex from the two decades he spent there.

He’s also familiar with startup chaos. After he left BMW in 2015, he helped co-found Chinese EV startup Byton, which is developing a similarly tech-forward electric SUV of its own. (Breitfeld abruptly left Byton earlier this year, and said at the media day that he wasn’t happy with the level of Chinese government interference after taking investment from a Chinese state-owned automaker.)

But expertise can only get you so far when dealing with someone like Jia, who is incentivized to maintain control of his company, as the two former high-level employees allege, and blinded by the same ego that compelled him to make that music video. One of them went so far as to say Breitfeld’s hiring is a “scam to make people think he has stepped aside.” Jia “has his arm up Carsten’s back and uses him like a puppet,” this person said.

“This comment is without merit and is baseless,” Schilling says in response. “Carsten has been on board here for almost two months now and has undertaken many strategic steps in his short tenure here to put [Faraday Future] back on track.”

Either way, Faraday Future is saddled with debt and has nearly exhausted its resources. The company must now somehow turn into a luxury car manufacturer (or an industry-disrupting force, if Breitfeld’s vision is to be believed). Even if Breitfeld or Jia has a fairy godmother who can magically make money appear, Faraday Future still needs $850 million to get the FF91 into production, according to both Breitfeld and Jia’s bankruptcy filing. It will then need to find even more money to fuel the grander ambitions that Breitfeld detailed in September, which the startup plans to generate by going public.

What cash Faraday Future does have right now has come from moves that don’t inspire confidence. There’s the $10 million loan from the Evergrande breakup, which Faraday Future is already late in paying. The startup sold its Los Angeles headquarters in March to generate some short-term cash, and it has since leased it from the new owners. On September 23rd, Faraday Future sold the land in Nevada where it once planned to build that $1 billion factory. The transaction price was $16.9 million — $23.1 million less than the original $40 million asking price. Citing the deal’s broker, the Las Vegas Review-Journal reported that “multiple prospective buyers” looked at the site, but “Faraday wanted to close the sale quickly, which led to a reduced price.”

Like its founder, Faraday Future has also continued to rack up debt. It borrowed $15 million from restructuring firm Birch Lake earlier this year, which it has paid back, according to Jia’s bankruptcy filing. But according to the same filing, Faraday Future also took a second $45 million loan from Birch Lake that is due at the end of October — a due date the startup is trying to extend because it can’t make the payment. Faraday Future has $801 million in total liabilities, according to the filing.

As of June 30th, Faraday Future even owed $4.4 million to Ocean View Drive, the shell company Jia used to buy his mansions. In fact, Jia’s bankruptcy filing reveals a number of new details like this. He borrowed $12 million from Faraday Future in 2014 to buy one of the mansions and some adjacent property. He bought another in 2015 using $7.5 million he borrowed from Lesoar Holdings, the holding company he used to make LeEco’s investment into Lucid Motors.

In addition to his salary, Jia is also being paid $43,000 per month in rent at his mansions by a company set up by his vice president. Jia even bought another new $3 million home in August — one month before Breitfeld was announced as CEO — with a shell company set up by his vice president, according to a person familiar with the sale and property records viewed by The Verge. The 3,300 square foot residence is just up the hill on the Palos Verdes Peninsula from the coastal mansions he already owns. (Schilling denies Jia purchased the home.)

Jia’s habit of loading up on debt and then leaving it behind, along with his propensity for questionable transactions, has already caused lawyers for one of his many creditors to call his bankruptcy a “sham” and “a flagrant abuse of US bankruptcy law.”

The lawyers, from high-powered international law firm Kobre & Kim, represent a Chinese asset management firm called Shanghai Lan Cai; Jia owes the firm about $11 million. In an official response to Jia’s bankruptcy filing, they told the court they believe Jia is hiding assets from creditors using shell companies and other means of obfuscation.

They also allege that some of the creditors Jia listed in his filing are companies related to or controlled by the tycoon. The lawyers claim that the legal discovery they performed after their April judgment showed that Jia “emptied out at least one of his bank accounts, transferring the balance to a human resources director at Faraday Future” shortly after they originally filed suit in the US.

The lawyers also allege that the plan Jia laid out in his bankruptcy filing is little more than a ruse to clear himself of liability, one that could actually pave the way for him to maintain control over Faraday Future. (Lawyers for Jia did not respond to a request for comment.)

“We are skeptical of Jia Yueting’s stated intentions to ‘step down’ or otherwise loosen his control over Faraday Future, given that his proposed plan says nothing about who will control the company going forward,” Kobre & Kim lawyer Chris Cogburn said in a statement to The Verge. “This plan does not jibe with Jia’s assurances about limiting his role in the company’s future, which appear to have been just another tactic to comfort investors who are rightly wary of his track record of mismanagement.”

One of the former high-level Faraday Future employees agreed, calling the bankruptcy filing “a gun to the head of the creditors.”

Faraday Future’s continuing existence depends on Breitfeld’s ability to woo investors, calm suppliers, but most importantly, keep Jia in check — none of which are given. One thing was certain at Faraday Future’s media day, though: through all its ups and downs, there has been no shortage of ideas, something that is reinforced by design director Page Beermann’s presentation.

Dressed in Nike sneakers, jeans, a black jacket, and a designer T-shirt that had, among other words, “delusion” printed on it, Beermann ran the members of the media through a laundry list of previously secret ideas that he and others have cooked up over the last few years. This included everything from the expected, like renderings of a Faraday Future coupe and roadster, to the bizarre, like a Faraday Future helicopter and yacht. He even showed a mockup of a lounge chair modeled after the lay-back rear seats in the FF91.

At the start of his presentation, Beermann — who also hails from BMW and has stuck with Faraday Future since 2015 — read a quote from theoretical physicist Freeman Dyson: “It is our task, both in science and in society at large, to prove the conventional wisdom wrong, and to make our unpredictable dreams come true.”

“That’s why working at Faraday is a dream job,” Beermann said.

Jia was absent from the media day, but this presentation felt like the kind of thing the tycoon would appreciate. As he sang to his employees in the 2017 internal music video: “[To] the people who understand me the most, thank you for silently accompanying me, and giving me a good story to tell.”

Update October 31st, 4PM ET: Added comment from Faraday Future denying Jia purchased a new house.

Got $5000 to spare? Reserve the FF 91 Futuristic edition

The Car with Oxygen Tank!

Is The Future bright or not for Faraday Future?

Source The Verge