We promptly confessed to Amazon, and VP of Amazon Go Gianna Puerini in return told us not to worry about it, and said that it’s an extremely rare error.

“First and foremost, enjoy the yogurt on us,” Puerini said. “It happens so rarely that we didn’t even bother building in a feature for customers to tell us it happened. So thanks for being honest and telling us. I’ve been doing this a year and I have yet to get an error. So we’ve tried to make it super easy on the rare occasion that does happen either to remove it or enjoy breakfast on us.”

Siggi’s didn’t seem to mind the lost sales either.

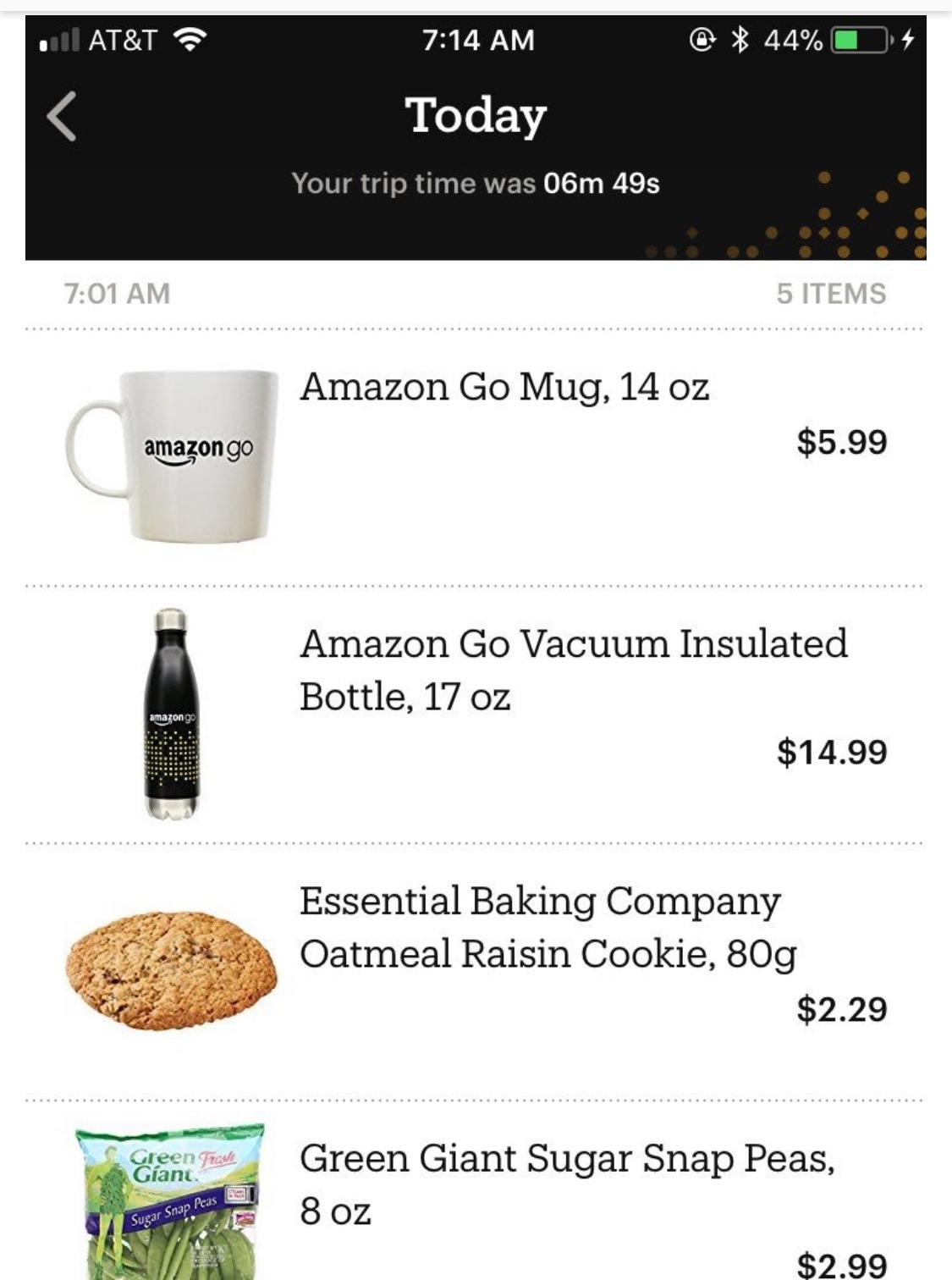

The technology is intended to disappear for shoppers, Puerini said. Just sign in with the Amazon Go app when you enter the store and shop as you normally would. The app keeps track of what you pick up and put back on the shelves, and charges you for your final items when you leave through sensing gates.

“The technology has been working great,” she said — free yogurts aside.

Puerini said the company has no plans yet to introduce the technology into Amazon-owned Whole Foods locations or to license the technology to other retailers.

But it’s got a heavyweight supporter.

“Jeff [Bezos] has been aware. He loves the store — he definitely has shopped it,” Puerini said. “He’s been super supportive and wonderful.”

By CNBC