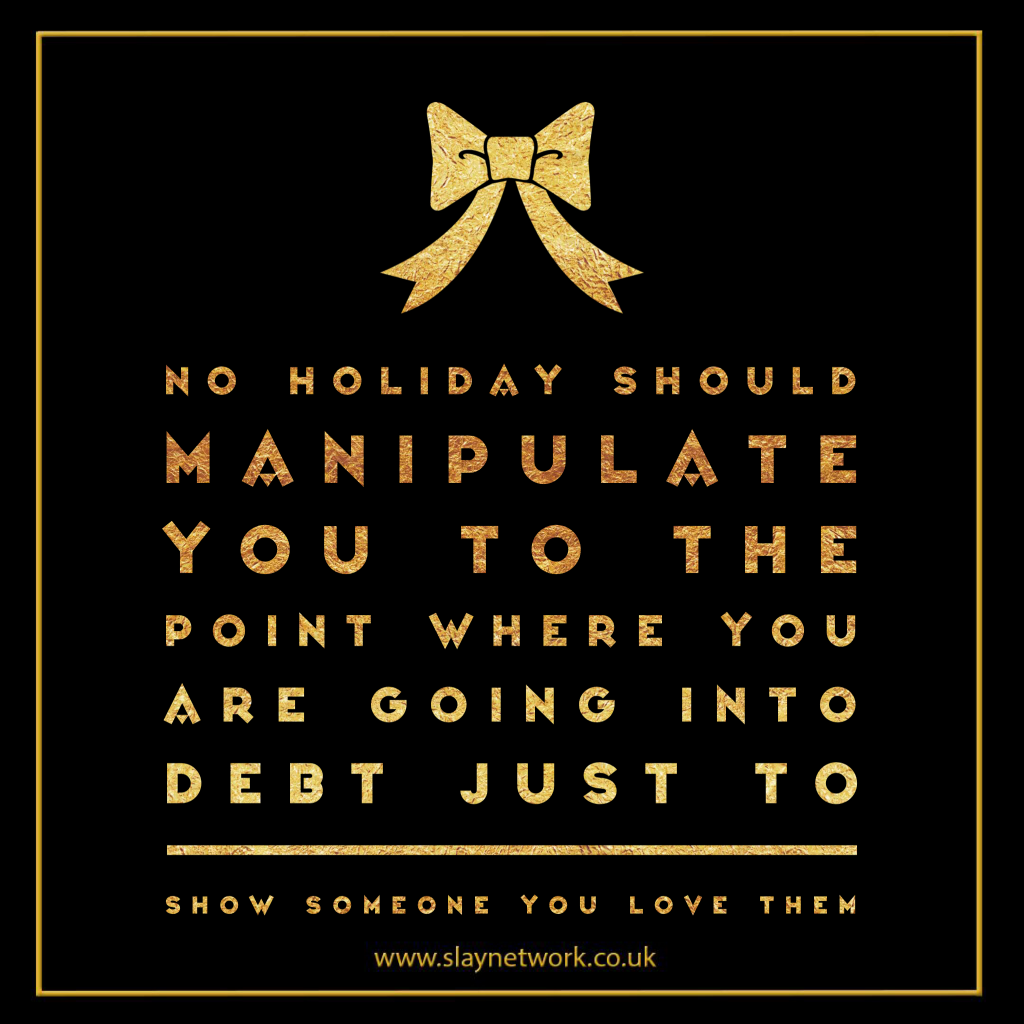

It’s only a few short weeks until Christmas. Stores are gearing up for the mad rush we call holiday shopping, hoping the last 6 weeks of the year will keep them in the black. My big wish for everyone this holiday season is to keep your own budget in the black. How many of you have started a new year with less money or more bills that you planned? Here are 5 reasons why I think people spend too much money over the holidays and how you can avoid the traps retailers use to get more of your hard earned money.

1) Credit

This was always our Achilles Heel at Christmas or really anytime we went shopping. If we didn’t have the money, it didn’t matter. It’s so easy to get caught up in the moment, swipe the card, and not think about it until the bill comes next month.

To avoid overspending, set a limit for gifts and once you’ve hit the limit, stop. If you can’t be trusted with credit cards, shop with cash or purchase gift cards in the amount you can afford. Once the money is gone, it’s impossible to overspend.

2) It Was A Good Deal

I have a theory that most people who go Christmas shopping end up buying lots of stuff besides Christmas gifts. It’s hard to pass up a buy one get one half off deal or walk past the store with brand new TV’s at the “lowest prices of the season.” I know tons of people, self included, who have even bought new cars around Christmas because dealers are trying to clear out this year’s models and offering, “once in a lifetime pricing.”

I have news. Once in a lifetime pricing usually happens once or twice a year. Now that I’ve been on the sidelines of consumerism for a while, I’m able to see past the hype and I notice that stores do the same thing every year to attract unsuspecting consumers. Ignore it.

If you are looking for a specific product you’ve deemed necessary or valuable, then go look for crazy deals or sales, but don’t buy things simply because they are on sale.

3) Not Cutting Back in Other Areas

Ideally, in January, we should start planning our Christmas budget. If you want to spend $2000 on Christmas, you’d need to save $166.67 every month. I started doing this years ago. I opened up a Capital One account, earned the new account $50 bonus, and had $75 a month direct deposited from my paycheck every month. By Christmas, the money is already there and there are no worries about holiday spending.

Sadly, most people don’t plan that far ahead. It would still be easy to afford the holidays if you cut back on other spending, but most people do the opposite. Money spent on eating out, travel, personal care like haircuts and manicures, new clothes, and buying home decor all increase toward the end of the year. If you haven’t saved, you’ll need to pick and choose how you spend money over the next month and a half. Is that new dress for your holiday party or that really cute singing reindeer worth going into debt?

December is the perfect month for no clothes shopping or eating out of your pantry. Will anyone really notice if you wear last year’s dress or don’t have Frosty the Snowman mugs to serve eggnog?

4) Going Shopping Out of Boredom

This was also a big trigger for us. We have some time off over the holidays. All the stores look festive. It’s cold and dark. Why not go to the mall? We don’t have to buy anything. We’ll just look around. If you do this, then go back up to numbers 1 and 2. Shopping out of boredom is a great way to make yourself broke. Unless you have superhuman will power, it’s easy to get sucked up in the season of consumerism.

I’m making it a goal to have Christmas shopping done before Thanksgiving, and 90% of it will be from Amazon. I will not be tempted by Christmas music, pretty displays, or one day only sales. I also think if you wander out on huge shopping days like Black Friday, you’ll get caught up in the momentum and buy things you hadn’t planned on buying.

If you need to get out of the house, why not….

* Drive around and look at Christmas lights

* Go to a movie

* Go ice skating

* Take a walk

* Build a snowman

* Volunteer for a charity

* Go to a community concert or play

* Work out

Not all of those things are free, but they are a heck of a lot cheaper than going shopping because you’re bored!

5) Waiting Until the Last Minute

I understand that we are all busy, but waiting until the last minute for Christmas shopping is a sure way to spend more than you planned. Selection is worse. Shipping costs are more. You don’t have time to comparison shop. You’re tired of being stressed and spend more just to be done.

I hate feeling rushed or being behind. It takes the joy out of the season and turns me into a big Grinch. I am always shocked by the statistics about people who wait to do holiday shopping on Christmas Eve. If that’s you, make it a challenge to be finished early this year. Use those last hours before Christmas to relax and spend more time with your loved ones. I bet you’ll save money and avoid lots of premature gray hairs.

What is your Achilles Heel when it comes to holiday spending? Do you plan ahead or wait until the last minute?

Click here to become a Slaylebrity Curator