Rachel Maddow set the internet abuzz on Tuesday night after tweeting that her show had acquired President Trump’s tax returns — and later that evening, the MSNBC host did not disappoint.

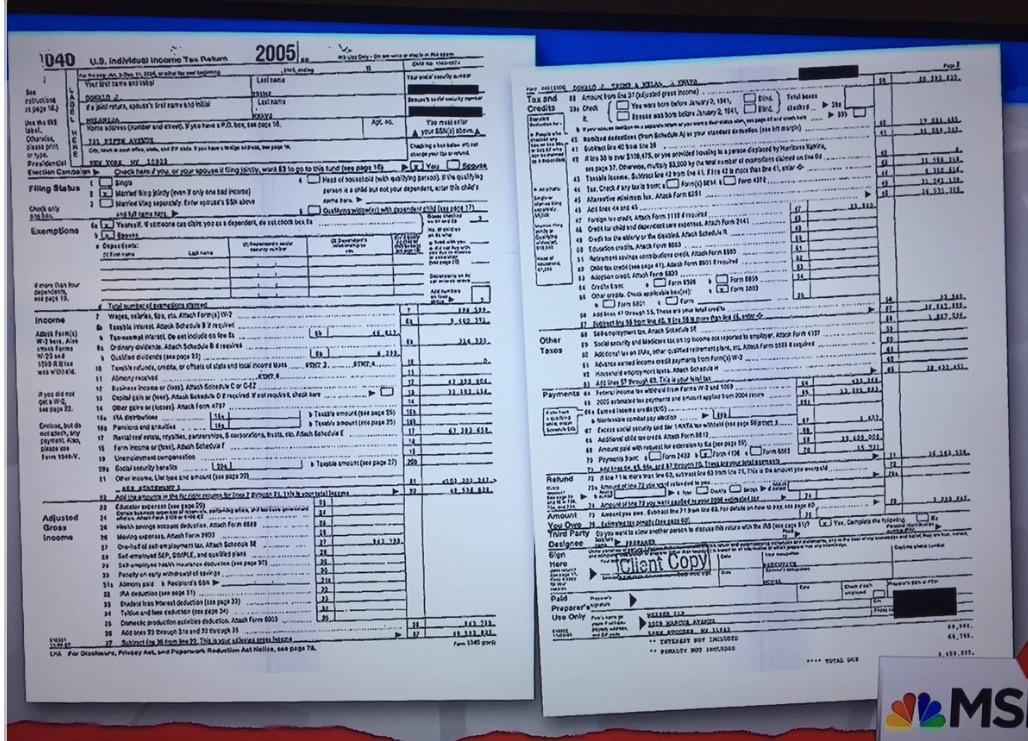

After months of excuses from Trump and his team as to why he hasn’t released his tax returns (despite repeated requests that he do so), The Rachel Maddow Show decided to take matters into their own hands this week by releasing the president’s 1040 form from 2005 on Tuesday evening. The segment began by explaining why, exactly, the president’s tax returns are of interest, particularly in regards to potential foreign conflicts of interest. Maddow then explained what they’d obtained and what can be gleaned from it.

While not quite the all-out, explosive exposé people were hoping for, the document did provide new insight into how Trump ran his businesses and why he might be avoiding releasing his more recent tax returns. First obtained by DCReport founder and editor David Cay Johnston, who claims he found the returns in his mailbox, the first two pages of Trump’s 2005 federal income tax return show that Trump earned over $150 million that year, and that he and his wife, first lady Melania Trump, paid a combined $5.3 million in regular federal income tax. In addition, the Trumps also paid $31 million in “alternative minimum tax,” something the president has previously said should be eliminated.