I became the original Facebook bull on Wall Street after I published the first Wall Street style research report on Facebook on Tumblr in March of 2010. My revenue forecast was simply my estimate of Facebook’s % of total internet time spent on the site multiplied by an estimate of the total global internet advertising market. My 2014 revenue estimate of $12.3 billion was off the actual 2014 revenue of Facebook by 1%. It turns out that Facebook is simply monetizing people’s attention.

I remained a Facebook bull for almost eight years, as the company continued to increase user engagement (defined as DAU/MAU once the company became public and started reporting results). I’ve long believed that sites are either growing engagement, or they’re dying, and for eight years, Facebook was growing user engagement.

But when the company reported Q4 ’17 earnings on January 31st, 2018, for the first time in it’s history, Facebook’s user engagement declined, and I turned bearish, penning this blog post to note the occasion.

On April 25th, Facebook reported it’s Q1 ’18 earnings, and Wall Street applauded the results, sending the shares up almost 10%, adding more than $45 billion in market cap, as Facebook’s quarterly revenue surged 49%, year-over-year, to $12 billion. While I saw impending doom in Facebook’s results, Wall Street was cheered, because Wall Street, even after all these years, still doesn’t understand Facebook. Wall Street has never understood Facebook, because Wall Street doesn’t understand two fundamental things.

The One Chart Wall Street Should Focus On

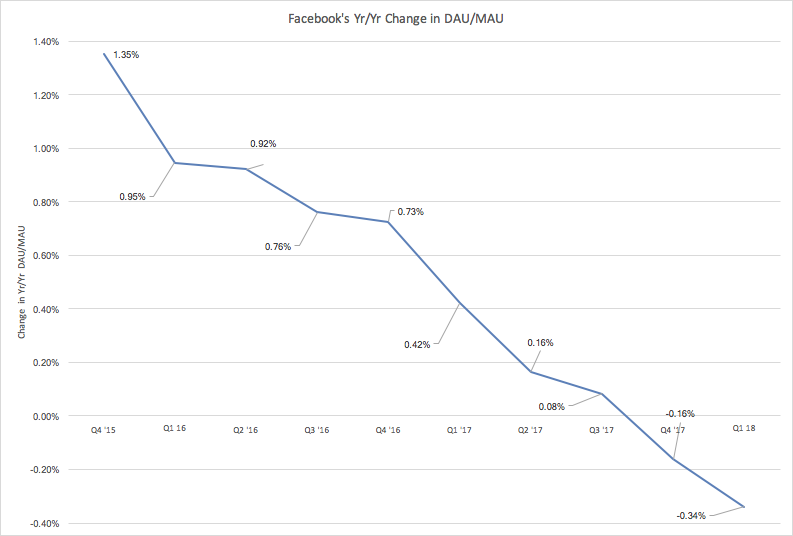

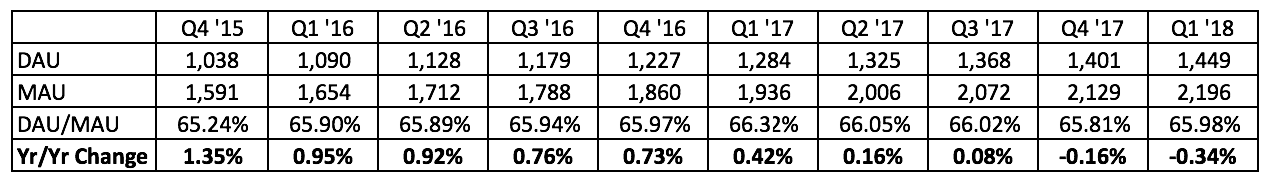

On it’s earnings call, Facebook presented slides that included 20 different graphs. But in my opinion, the most important graph is below, which shows the year-over-year change in user engagement, which is defined by Facebook as Daily Active Users/Monthly Active Users (DAU/MAU). It is not a pretty picture:

In other words, the average Facebook user is spending less time on Facebook. Given that Facebook’s main model is to monetize user time, less time per user is ultimately disastrous

The Second Thing Wall Street Doesn’t Understand About Facebook

As I wrote in my January 31st post “revenue growth is a lagging indicator of engagement growth”. In other words, advertisers are increasing their advertiser spend to catch up to the years of incredible growth in users and user engagement. So Wall Street is cheered by the revenue growth, not realizing it’s the result of user growth and user engagement growth from year’s past.

It will be a number of quarters before Faceboook’s revenue mirrors the decline of Facebook’s user engagement. But the user engagement increase that powered Facebook’s stratospheric rise in valuation has come to an end. Facebook’s user engagement decline is now accelerating. Investors beware.

By Lou Kerner

If you would like to share your content on the worlds most elite network platform click here